Accounting Finance:Depreciation-Work with Asset Depreciation

(Redirected from Accounting Finance:Proposal for Asset Depreciation)

Jump to navigation

Jump to search

Overview

- There are two types of depreciation proposals.

- They are work proposal and Update proposal.

- A work proposal can be created for a selection of assets, whereas an update proposal must include them all.

- Proposals with errors can never be updated, the errors must be corrected and you have to create a new proposal.

- Depreciation calculations are based on the depreciation rules and their connected modules.

- If asset balance accounts are changed during the life of an asset, the system will automatically create balance movements in the following depreciation run. The system will give a warning that such balance movements will be performed.

Create a Work Proposal for Asset Depreciation

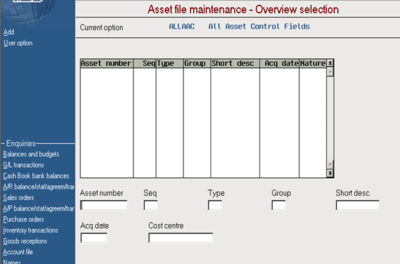

- Click Asset Management→Asset management financial tasks→Depreciation tasks→Work with depreciations.

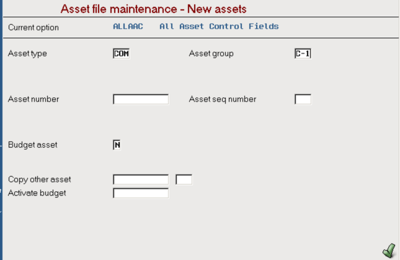

- Click Add (left side blue panel)

- Enter the Asset type

- Enter the Asset group

- Click enter and asset number will be filled in

- Click enter again

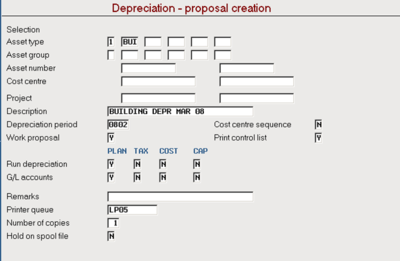

Depreciation-Proposal Creation

- Enter Selection (optional)

- Enter Description

- Enter Depreciation period

- Change Work proposal Y (the default for NO signifies that this will be an update proposal. YES signifies a work proposal to simulate depreciation for selected assets before updating)

- Change Print control list Y

- Click enter

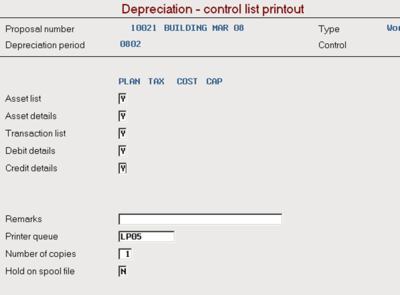

Depreciation-Control List Printout

- Change Asset details Y

- Change Credit details Y

- Click enter

- Press F12 to move back to previous panel

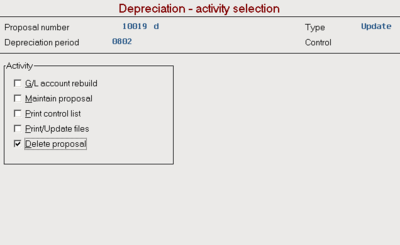

Proposal Deletion

- Click Work with depreciations

- Double-click depreciation proposal

- Click Delete proposal (to delete the work proposal)

- Click enter

- Click Delete (left side blue panel)

- Click F12 to move back to previous panel