Accounting Finance:Accounting Finance:CIBC-Daily Cashbook Clearing

The Cashbook is cleared daily to ensure that the amounts entering and leaving the bank account are recorded correctly in the GL.

Print Transaction Detail Report

- Log into the CIBC CMO Website

- In order to retreive a copy of the prior day's transactions, select Information Reporting and click Edit for Prior Day Transaction Detail.

- Select prior day’s date, select the correct bank account (CAD uniPHARM Wholesale Drugs Ltd.), and add to accounts included in report before viewing report and printing

Cashbook Clearing

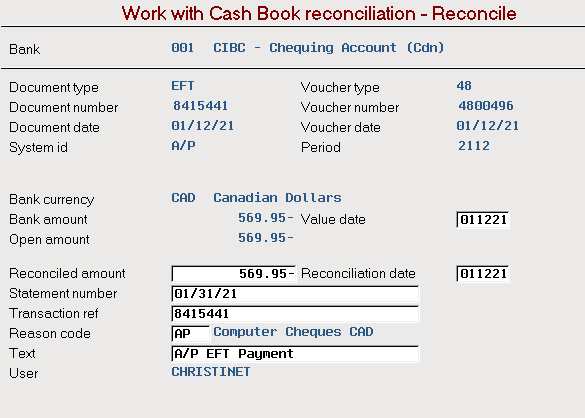

- Navigate to ASW --> GF460 - Work With Cash Book Reconciliation

- Enter 001 under bank for CIBC CAD

- Clear the amounts on the report from the cashbook. Enter the file type you are clearing (ex EFT) into the DT column to navigate quicker.

- Select the file you are clearing and click Reconcile

- Change the Reconciliation date to the date the item cleared the bank (date on the report)

- Do not change the Value Date

- Enter the month end date into the Statement Number in the following format - MM/DD/YY. Use the last day of the month, not the current date*

- Once confirmed the transaction has been cleared, press F10 to complete the clearing process.

- If item not found in cashbook, track items on the CIBC Missing Amounts spreadsheet. Inquire with Donna or Christine to determine if remittance advice from the vendor/customer have been received.

Clear once entered.

- Enter the amounts for the Credit Card Reposition in the Visa & MC Transfers spreadsheet (Common -> AR -> Banking-> CIBC)