Accounting Finance:Equifax and Trade Reference Checks

Overview

Our data assets, technology and analytics transform knowledge into insights that power better decisions. This knowledge enables our customers to make better business decisions and consumers to progress towards a better life.

We serve as a consumer advocate, steward of financial literacy, and champion of economic advancement. As an innovative global information solutions company that enables access to credit, we’re part of breakthrough collaborations and innovations that address complex social challenges such as social welfare, community relations and financial education for underprivileged youth. We establish relationships that create economically healthy communities. We help individuals gain financial independence by increasing access to capital and micro-lending for small businesses. And we provide young adults entering college or university with financial education tools.

Turn around period

- No account should be set up without prior approval by management (look for the authorized signature on customer application)

- All credit checks should be completed with 2 business days (48 hours) unless there are special circumstances such as waiting for a trade reference to be returned.

Credit Report Requirements

- Shareholders → all checks are required (consumer, business, bank, and trade references)

- Customer/Associate Member:

- Equifax score (0-20) → only consumer and business credit reports are required

- Equifax score (21-30) → all checks are required

- Equifax score (>31) → applicant rejected unless approved by management

- No Equifax report → bank and references checks are required

- GA & GSA → all accounts less than 1 year in business are required to submit a GA & GSA. This is required before we set up and generate a customer number

Reports & Services Available

- Consumer Credit Report $9.50 (credit reporting on principals of company). Report is available via Equifax internet and downloaded by user. Billed at the price per report

- Commercial Credit Report $29.90 (credit reporting on company). Report is available via Equifax internet and downloaded by user. Purchased as a block of 50 reports annually

- Single Item Report $14 (verification of a single trade reference, bank reference or other information). Guaranteed 72 hour service and is billed at the price per report

- Full Investigative Report $50 (one bank, three trade supplier experiences, principal interview or a corporate search and the contents of any credit report that may already be available on the database). Guaranteed 72 hour service and is billed at the price per report

Easy Access to Equifax

- 1.877.254.3263 (bank verification and investigation)

- 1.800.567.2370 (new bank verification and investigation)

- 1.877.227.8800 (customer service)

- 1.514.493.2401 (fax number)

- 1.877.257.2090 or Equifax (general inquiries)

- Note: ask for a reference number when calling in case you need to follow up later

- Be ready with our uniPHARM Equifax member number: 201WD00143

Logging on to Equifax

- Go to https://www.equifax.ca/credit/

- Enter Client ID → UNIPHARM

- Enter User ID (if you do not know, contact Manager, Finance)

- Enter Password

- Click Sign-on

- Click Continue

Consumer Report

A consumer report is used to check into the credit history of an owner of a company.

- Click Report under the Consumer Header in the left column.

- Fill in all the required fields and any additional information

- Click Submit

- Print and review the report. Under the Trade Information header, check the rating

- If the rating is R1 → proceed to do the commercial report

- If the rating is greater than R4 → proceed to do a bank verification and 2 trade references (done independent of Equifax).

- If this is for a shareholder → do a commercial report as well as a bank verification and 2 trade references

Business Credit Report

A Business Credit Report is used to check into the credit history of the company. It is best to check the legal name rather than the operating name.

- Click Business Credit Report under the Commercial Header in the left column.

- Fill in all the required fields and any additional information

- Click Submit

- Double-click the correct company. Check addresses to confirm company.

- If the business credit report score is:

- 0-20 (low to average risk) → no credit checks are required

- 21-30 (above average risk) → a bank reference and 2 trade references are required and must be sent out immediately. Follow-up is required until we receive them back.

- ≥ 31 (high to highest risk) → the applicant is automatically rejected unless approved by management

- No Equifax report → a bank reference and 2 trade references are required

- Fairly new customers or shareholders may not show up on the system

Single Item Report

The single item report is used to obtain a bank reference.

- Click Resource Centre (last item on the right).

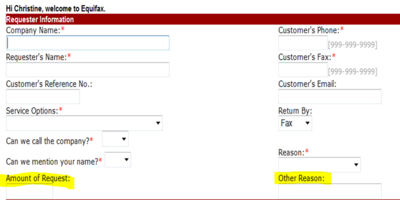

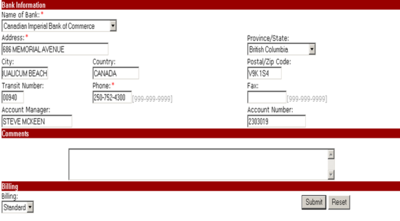

- Under member information center click Forms-Commercial Credit then click Commercial Investigate Service

- Fill out all required information on form highlighted in yellow (no need to fill out the principal suppliers section)

- Click to Attach check Sp and Click to Attach to client Application.

- 'Can we call the company→ No

- Can we call mention your name?→ No

- Amount request: $10,000 (for new account set-up)

- Other reason: to open an account.

- Enter required information

- Click Submit

- Normally you should be receiving a response within 2 business days, if not contact 1-877-254-3263 or 1-800-567-2370 to follow-up. Our member number is 201WD00143.

- Sometimes they may reply back saying that the bank needs the client’s signed authorization. At this point you may email them page 2 of the customer application which shows the customer agreeing to our terms and conditions.

Trade References

In order for new customers to open an account with uniPHARM we require 2 trade (credit) references from them (on the application form).

- Click to Trade Reference Form[1]

- Fill out the necessary information and at the bottom of the form tick the appropriate box whether this is a first, second or third request.

- Once completed you may either click File and choose to attach it to your email or click on the Submit Form by Email button at the bottom of the document.

- Should you choose to click on the button. The email will be sent via accountsreceivable@unipharm.com. Make sure you have access to this common email before you click the button.

- Remember to follow up the request with the respective suppliers within the week you sent in the form!